The transition from the historical use of the abacus to the advanced era of Artificial Intelligence (AI) marks a profound evolution in accounting methodologies, highlighting a move from traditional techniques to cutting-edge technological innovations. This transformative journey has seen the advent of cloud accounting, enabling real-time data access, process streamlining, and improved decision-making capabilities. The integration of AI into accounting processes is revolutionizing the field by automating data entry, enhancing predictive analytics, and refining auditing and risk assessment for more accurate and efficient financial reporting.

Benefits of Artificial Intelligence (AI) in Accounting

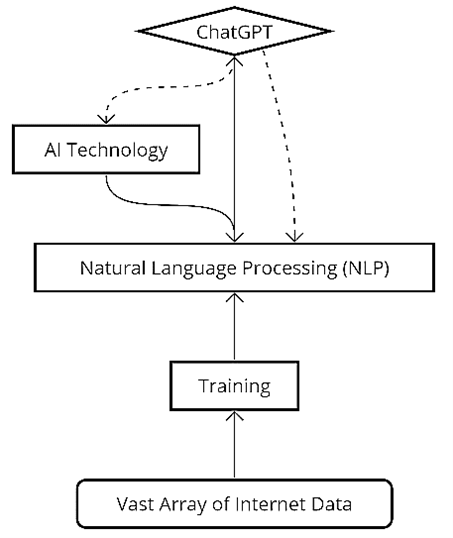

AI represents a collection of technologies capable of executing tasks usually demanding human intelligence, including perception, reasoning, learning, and decision-making. AI’s utility spans automating routine tasks, enhancing human capabilities, and fostering innovation. A standout AI technology, Natural Language Processing (NLP), empowers computers to process and mimic human language, exemplified by ChatGPT. This NLP-based AI model (see Figure 1), renowned for generating articulate responses to natural language inquiries, belongs to the generative language models family, trained on extensive human language datasets to produce text mirroring human communication. ChatGPT’s effectiveness stems from its training on a vast array of internet data, enabling it to deliver coherent, contextually appropriate responses across diverse prompts. For the accounting professionals, this means an ability to interact with AI systems using natural language, making it easier to query financial databases, interpret complex documents, and generate reports without needing specialized programming skills, marking a shift towards a more analytical, insight-driven approach in accounting, where the ability to quickly interpret and act on complex information becomes a key competitive advantage.

Figure 1. ChatGPT & NLP

Role of ChatGPT in Accounting

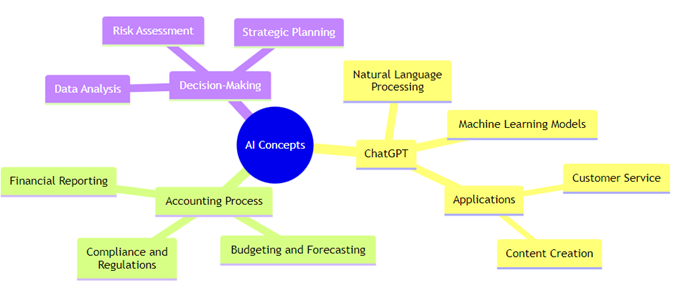

In accounting, the adoption of ChatGPT and related AI technologies offers numerous advantages, such as streamlining routine tasks, enhancing accuracy, and lowering operational costs, alongside augmenting human accountants’ capabilities with new insights and recommendations for more informed decision-making (see Figure 2). Nevertheless, the integration of ChatGPT and AI into accounting also brings potential risks and ethical concerns, including data privacy, bias, and accountability issues. It’s crucial to navigate these challenges thoughtfully, ensuring AI’s application in accounting remains responsible and ethically sound.

Figure 2. ChatGPT, Accounting Process and Decision-Making Relationship

AI in accounting offers numerous benefits, including the automation of routine tasks like data entry and reconciliation, which frees up accountants’ time for more complex activities and reduces errors. It enhances accuracy and speed by quickly processing large datasets with minimal errors, and its advanced data analysis capabilities uncover patterns and insights that might elude human detection, aiding in more informed decision-making. AI-powered chatbots enhance customer service by providing round-the-clock support, lightening the load on human accountants and boosting customer satisfaction. In the audit domain, AI streamlines tasks such as data analysis and documentation, leading to more efficient and accurate audits. It plays a crucial role in fraud detection by identifying data anomalies and patterns indicative of fraudulent activities, thus mitigating financial risks for businesses. AI also improves forecasting and budgeting through its analysis of past data, enabling better business planning. Overall, by automating tasks and enhancing efficiency, AI reduces the cost of accounting services, making them more accessible, even to small and medium-sized enterprises.

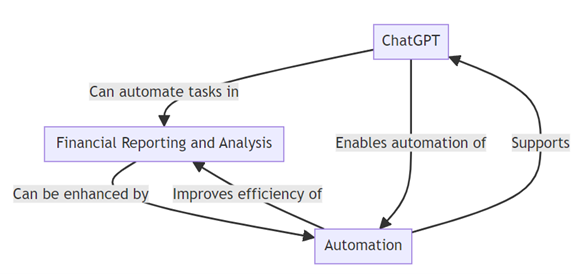

Overview of Financial Reporting

Financial reporting involves the preparation and presentation of a company’s financial information in a structured manner to stakeholders, including investors, creditors, and regulators. This process aims to convey the company’s financial performance and position through key reports like the balance sheet, income statement, and cash flow statement. The balance sheet details the company’s assets, liabilities, and equity at a particular time, the income statement outlines revenues, expenses, and net income over time, and the cash flow statement tracks cash movements within the company. As a crucial aspect of accounting, financial reporting aids in decision-making and evaluates a company’s financial health, emphasizing the need for accuracy and transparency to maintain stakeholder trust and meet regulatory standards. Traditionally manual and resource-intensive, financial reporting has been transformed by technologies such as ChatGPT and AI, which automate the process, enhancing its speed, accuracy, and efficiency (see Figure 3).

Figure 3. Automation of Financial Reporting

ChatGPT’s role in financial reporting, illustrates its capabilities to automate report preparation, generate valuable insights, and significantly improve reporting accuracy and speed. The integration of ChatGPT into financial reporting processes promises a transformative shift in how accountants operate, enabling them to focus on more complex tasks, thereby elevating the level of service provided to clients and stakeholders through technology-driven efficiency and accuracy.

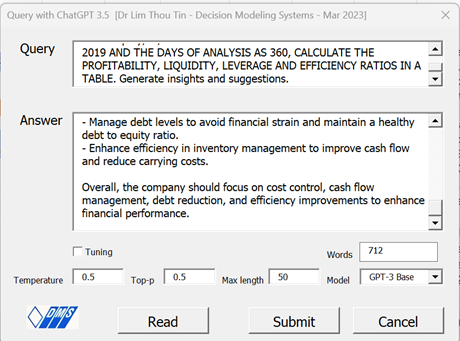

How ChatGPT Can Automate Financial Reporting

ChatGPT can significantly streamline financial reporting processes through automation in several key ways. First, it can automatically extract data from critical financial documents like balance sheets, income statements, and cash flow statements, eliminating manual entry errors and saving time. It can also reconcile data from various sources, including bank statements, invoices, and receipts, ensuring accuracy and consistency across all financial data. Additionally, ChatGPT is capable of analyzing financial data to generate insights and suggestions, such as identifying trends, variances, and anomalies, and offering recommendations to enhance financial performance, increase profitability, or cut costs (see Figure 4).

Figure 4. Financial Report Analysis

Moreover, it can automatically generate financial reports, ensuring they are accurate and consistent, based on the analyzed financial data. Lastly, ChatGPT helps maintain regulatory compliance in financial reporting by detecting and highlighting any discrepancies or errors, ensuring that reports meet all regulatory standards. The relevance of ChatGPT and AI in financial reporting touches on every aspect of an accountant’s professional life, from operational efficiency and accuracy to strategic decision-making and regulatory compliance. The adoption of these technologies is not just about keeping pace with the digital transformation but also about seizing opportunities to redefine the value and scope of the accounting profession.

Challenges in Adopting ChatGPT for Accounting Professionals

The integration of ChatGPT and AI into financial reporting, while beneficial, brings forth a set of challenges that accountants must navigate. Technical complexity stands as a significant hurdle, as the adoption of these technologies necessitates acquiring new skills or relying on IT specialists. Concerns over data privacy and security are paramount, given the stringent requirements for handling financial data. Additionally, the effectiveness of AI in financial reporting is contingent upon the quality of input data, with poor data quality potentially leading to inaccurate outcomes. The risk of developing an over-reliance on technology and the associated potential for skills degradation among professionals, along with the challenges of ensuring AI-generated reports comply with evolving regulatory standards, further complicate the landscape.

Moreover, the financial implications of adopting AI technologies, such as the cost of implementation and training, can be particularly daunting for smaller firms. Change management issues, including resistance from within the organization and ethical considerations about AI’s role in decision-making, underscore the complexity of integrating AI into established processes. The inherent biases within AI systems and the ethical quandaries they present, alongside the challenge of correctly interpreting AI-generated insights within a business context, highlight the need for a thoughtful and informed approach. Addressing these challenges requires a blend of technological savvy, continuous learning, and ethical vigilance to ensure that the deployment of AI in financial reporting maximizes benefits while minimizing risks.

Implementing ChatGPT in Financial Reporting

To effectively leverage ChatGPT and AI in financial reporting, accountants should embark on a path of continuous learning and collaboration with IT specialists. Engaging in educational programs and staying updated with AI advancements will equip them with the necessary skills to navigate the complexities of AI technologies. Prioritizing data privacy and ensuring the quality of data fed into AI systems are critical for maintaining the integrity and accuracy of AI-generated reports. A phased approach to implementing AI, starting with simpler tasks and gradually moving to more complex processes, can facilitate smoother integration and acceptance within organizations.

Staying informed about regulatory changes is essential to ensure compliance with financial reporting standards. Accountants must also be vigilant about potential biases in AI algorithms, actively working to mitigate these biases to ensure fairness and accuracy in reporting. Effective change management strategies, including clear communication and ethical considerations, will help address concerns and resistance to new technologies. By focusing on leveraging AI for both task automation and gaining strategic insights, accountants can enhance their efficiency, accuracy, and value in the increasingly digital landscape of financial reporting.

Conclusion

The integration of ChatGPT and AI into financial reporting heralds significant advancements in efficiency, accuracy, and strategic decision-making for accountants. The importance of continuous learning to the accountants and finance professionals to master the complexities of AI technologies and the necessity of working closely with IT professionals to ensure seamless integration and robust data security. High-quality data is crucial for the accuracy of AI-generated reports, and a phased approach to AI adoption can help manage the transition effectively. Accountants must stay abreast of regulatory changes to ensure compliance and be proactive in identifying and mitigating biases within AI systems to maintain fairness in financial reporting.

Effective change management and open communication are essential to address concerns and mitigate resistance within organizations. Ethical considerations should guide the use of AI in decision-making processes, ensuring that the technology aligns with organizational values. By leveraging AI not only for automating routine tasks but also for extracting strategic insights, accountants can significantly enhance their role and value in the financial reporting process. Embracing these technologies responsibly and ethically will enable accountants to navigate the challenges and maximize the benefits of AI in the evolving landscape of financial reporting.

Author: Dr. Lim Thou Tin

An IT & business strategist with a doctorate in Knowledge Management & Intelligent Systems. Experienced in corporate IT & educator at global institutions.

Website: medium.com/@limthoutin

LinkedIn: Profile

Bio: Dr. Lim Thou Tin is an experienced professional with a strong foundation in business and technology, complemented by a rich academic background. Holding a business degree from the National University of Singapore, along with master’s degrees in Information Systems and Knowledge Management, and a Doctorate in Business Administration from Southern Cross University, he brings a thoughtful approach to his work in professional training and consulting. Certified in Business Analytics and Adult Education, Dr. Lim focuses on enhancing the skills of professionals in finance, accounting, and auditing, particularly through the application of information technology. His career, marked by significant roles in IT, project management, and leadership within various sectors, has evolved into managing his own consulting practice in Singapore. Through his diverse experiences, Dr. Lim offers practical insights and solutions to businesses aiming to improve their operations and strategies.

Next events held by the article author

-

20 February 2025 : A Deeper Look at ChatGPT & AI Applications in Finance and Accounting

-

10 March 2025 : Accounting and AI: Exploring AI and Machine Learning using Excel